If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc the federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system.

Nys solar tax credit 2019 form.

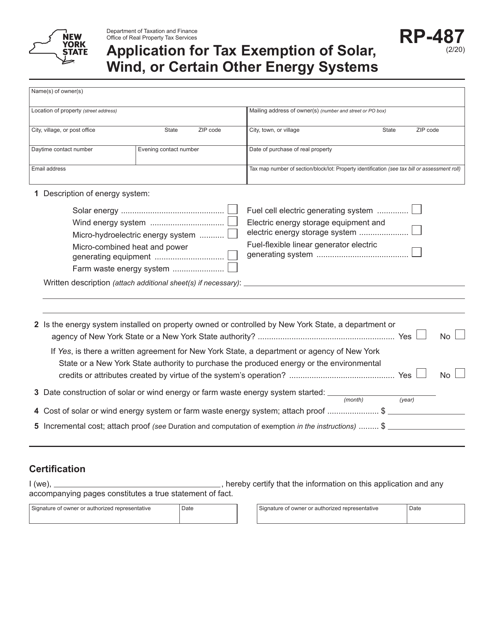

Department of taxation and finance.

5 minutes last updated on august 27 2020.

Form it 255 2019 claim for solar energy system equipment credit it255 keywords.

Solar energy system equipment credit.

The system must also be installed and used at your principal residence in new york state.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Have questions about your solar tax credits.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Form rp 487 from new york state department of taxation and finance.

There are so many incentives to go solar especially for new york residents.

To claim this credit fill out this form and include the final result of it on irs form 1040.

File this form with your local property assessor.